Richards Bay Port as a New Liquefied Natural Gas (LNG) HubSound Reasons for its Selection

A major announcement

In January 2024, the Transnet National Ports Authority (TNPA) announced the preferred bidder to design, develop, construct, finance, operate and maintain a new liquefied natural gas (LNG) terminal to be situated in the port of Richards Bay in KwaZulu-Natal Province, South Africa. As the preferred bidder, the Vopak Terminal Durban and Transnet Pipelines Consortium Venture will develop and run the LNG terminal in the South Dunes designated area of the port for 25 years. It will be a public-private-partnership (PPP) with the private sector party, Vopak, as the lead investor. Vopak is a Dutch company which specialises in LNG construction and operation. Transnet Pipelines (TPL) is the state-owned enterprise responsible for transporting petroleum and gas products.

My two business missions to Richards Bay Port

I first led a business mission to Richards Bay Port in June 2014. The objective then was to ascertain the port’s regional role in the evacuation of coal from Botswana and eSwatini, as well as its potential as a support base for LNG supplies from the Rovuma Basin in Mozambique and Tanzania.

The aim of the second mission in 2017 was to further investigate Richards Bay as one of South Africa’s officially designated gas import and distribution centre, and to assess the capacity of Richards Bay Industrial Development Zone to serve as such as a distribution point.

Overview of Richards Bay Port

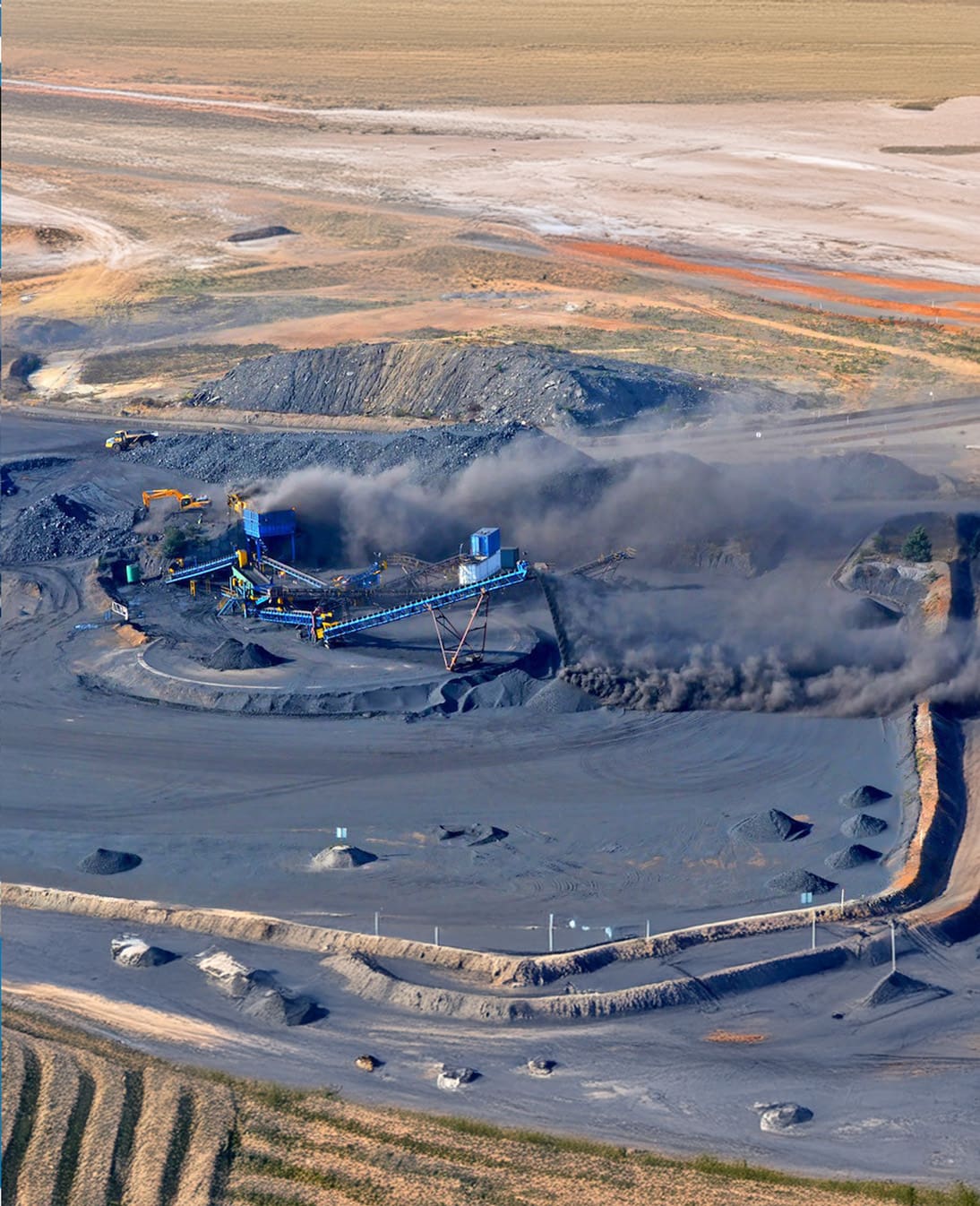

The first phase of construction of the harbour at Richards Bay was opened in April 1976. The primary reason for its development was the export of coal from the hinterland. The port thereafter expanded to handle bulk and break-bulk cargoes.

At the time of our 2017 mission, we were informed that Richards Bay ranked 43rd of 245 ports in the world. It was handling 32,7% of South Africa’s cargo with an annual throughput of around 100 million tons and servicing of 1 800 vessels per annum. Its depth of 17,5 to 19,5 metres enabled it to handle large vessels.

Today, the harbour has 23 berths for dry bulk, break-bulk, and liquid bulk. There is also a limited container handling facility handling just over 5 000 TEU’s annually.

The long-term development plan to 2040 includes a floating dock, new break-bulk, dry bulk and liquid bulk terminals and an upgrade of rail infrastructure. The South Dunes Development Programme includes a new berth. Much has been achieved and Richards Bay is a modern, 24-hour operation. There is sufficient available land for expansion.

Truck congestion on the N2 highway leading into the port has become a serious problem in recent times. In early 2024, the local authorities decided on a levy on coal trucks to reduce their numbers and prevent further deterioration of road infrastructure. Transnet has announced plans to ramp up usage of rail to transport coal to the harbour.

South Africa’s Need for Natural Gas

Natural gas is becoming increasingly accepted as a viable alternative or transitional source of power that will assist South Africa in dealing with its dire electricity shortage. Although, not a renewable energy, it is far cleaner and less expensive in capital cost than coal, (upon which the country is so dependent.) Indeed, gas has the advantage of completely negating the pollution output from other fossil fuel sources whilst halving the carbon emissions.

The draft Integrated Resource Plan (IRP) 2023 presented by South Africa’s Department of Mineral Resources and Energy (DMRE), has been described by analysts as “gas-heavy” because it refers to the building of 7 220 MW of gas-to-power (GTP) capacity. This is in contrast to the IRP 2019 which gave gas far less priority for the country’s future energy mix. However, analysts are forecasting that South Africa will need far more than the 7 220 MW GTP capacity mentioned in the IRP 2023.

Where will South Africa’s gas come from?

At the end of 2020, PetroSA halted operations at its gas-to-liquid fuels plant at Mossel Bay in the Western Cape Province due to a lack of gas feedstock from its satellite gas fields. Since then, the South African authorities have laid much more emphasis on future supply of gas from the recently-discovered deepwater Luiperd and Brulpadda fields in the Outeniqua Basin off the southern coast of the country. These fields are operated by TotalEnergies of France.

However, development of these fields to a point of commercial operation, will take at least seven years. There is not sufficient local gas to cover the interim period. Authorities refer to the importation of natural gas “in the short term.” PetroSA is referring to a deal with Mozambique’s national energy company, ENH, for the supply of Mozambican gas, with the first flows said to commence in late 2024.

We should not discount the possibilities of domestic, onshore gas becoming a part-solution for gas supplied to Richards Bay. Companies like Kinetiko Energy have discovered major sources of gas in shallow sediments in southern Mpumalanga, north-west KwaZulu-Natal and south-east Freestate Province. The Lily-1 pipeline runs through all three of Kinetiko’s current tenements, and there is the technical possibility of the collection and compression of high-quality, natural gas into this pipeline.

The Matolla Project as the quickest option

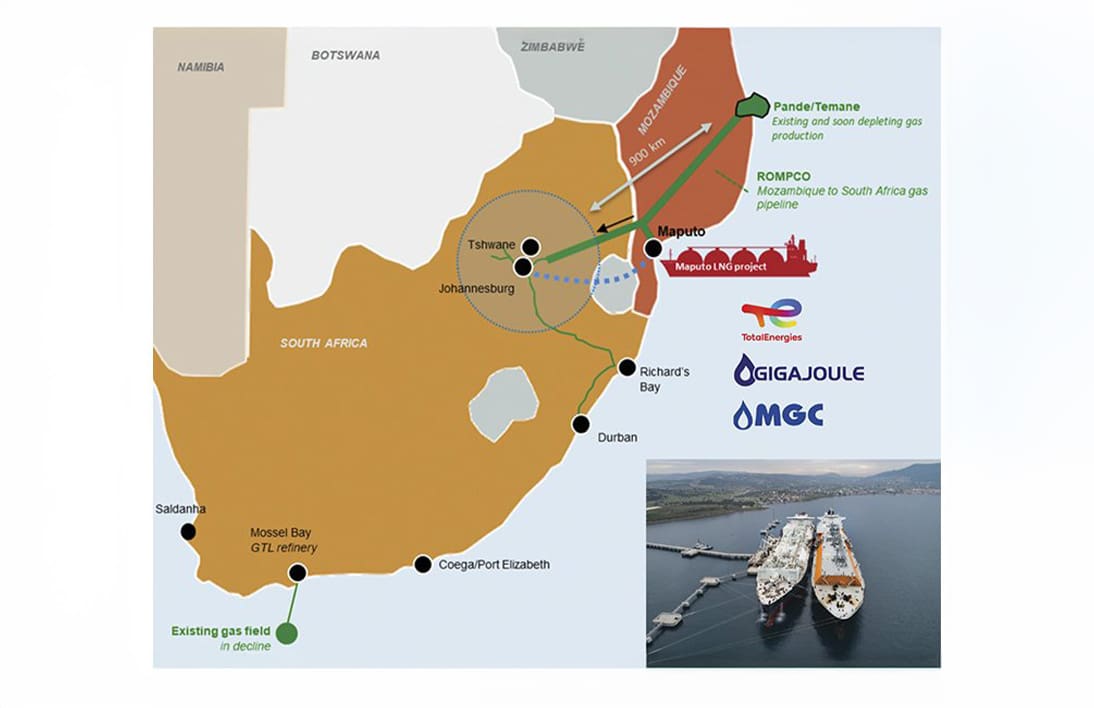

Gas supplies from the Pande and Temane gas fields in central Mozambique are declining. This gas is piped via the Mozambique-South Africa joint venture ROMPCO pipeline to SASOL’s plant in Secunda for power generation in South Africa. An alternative supply solution has to be found.

The Matola LNG Supply Project is accepted as the quickest possible solution. The final investment decision (FID) for the project, which is located in the far south coast of Mozambique near the South African border, is expected in 2024. A floating storage regasification unit (FSRU) will be moored at Matola. The developers, TotalEnergies of France, Gigajoule of South Africa and the Matola Gas Company of Mozambique are planning to supply South Africa with 1 000 MW of electricity.

Other than the power solution, this project would require an anchor offtaker, such as SASOL, to receive the gas via the ROMPCO pipeline.

Advantages of Richards Bay

Richards Bay harbour was established due to its proximity to sources of coal. The direct distance between Richards Bay on the northern coastline of KwaZulu-Natal and the coal fields of Mpumalanga Province is only approximately 350 kilometres. A dedicated rail line connects the port to these coal fields as well as to the industrial heartland of Gauteng Province.

Within the context of gas reception and geographic location, Richards Bay has considerable advantage over the other proposed gas hubs of Coega, Mossel Bay and Saldanha. There will however, be competition from these other proposed ports. Gas-to-power projects are planned for the Coega Special Economic Zone on the Eastern Cape coast. The Western Cape Provincial Government is promoting the importation of LNG via Saldanha Port.

Proximity to Mozambique and the Matola project is one advantage. The distance between Richards Bay and the Mozambican capital and Matola is some 320 kilometres. Richards Bay could act as a gas consolidation and distribution point for gas from Matola. Its Industrial Development Zone is already linked to SASOL in Secunda through the ROMPCO pipeline. There is also the possibility of feeding gas up the Lily-1 pipeline in reverse directly to SASOL as an anchor offtaker. The Lilly-1 pipeline is an operating natural gas pipeline between Secunda and Durban via Newcastle and Richards Bay.

Richards Bay is an ideal location for the LNG gas terminal because it already has some required infrastructure and land. It is also connected to regional railways. Oil and gas consultant Niall Kramer, ex CEO of the South African Oil and Gas Alliance (SAOGA) believes that “We will need oil and gas at least until the middle of the century” and “the Richards Bay LNG terminal is possible and desirable.”