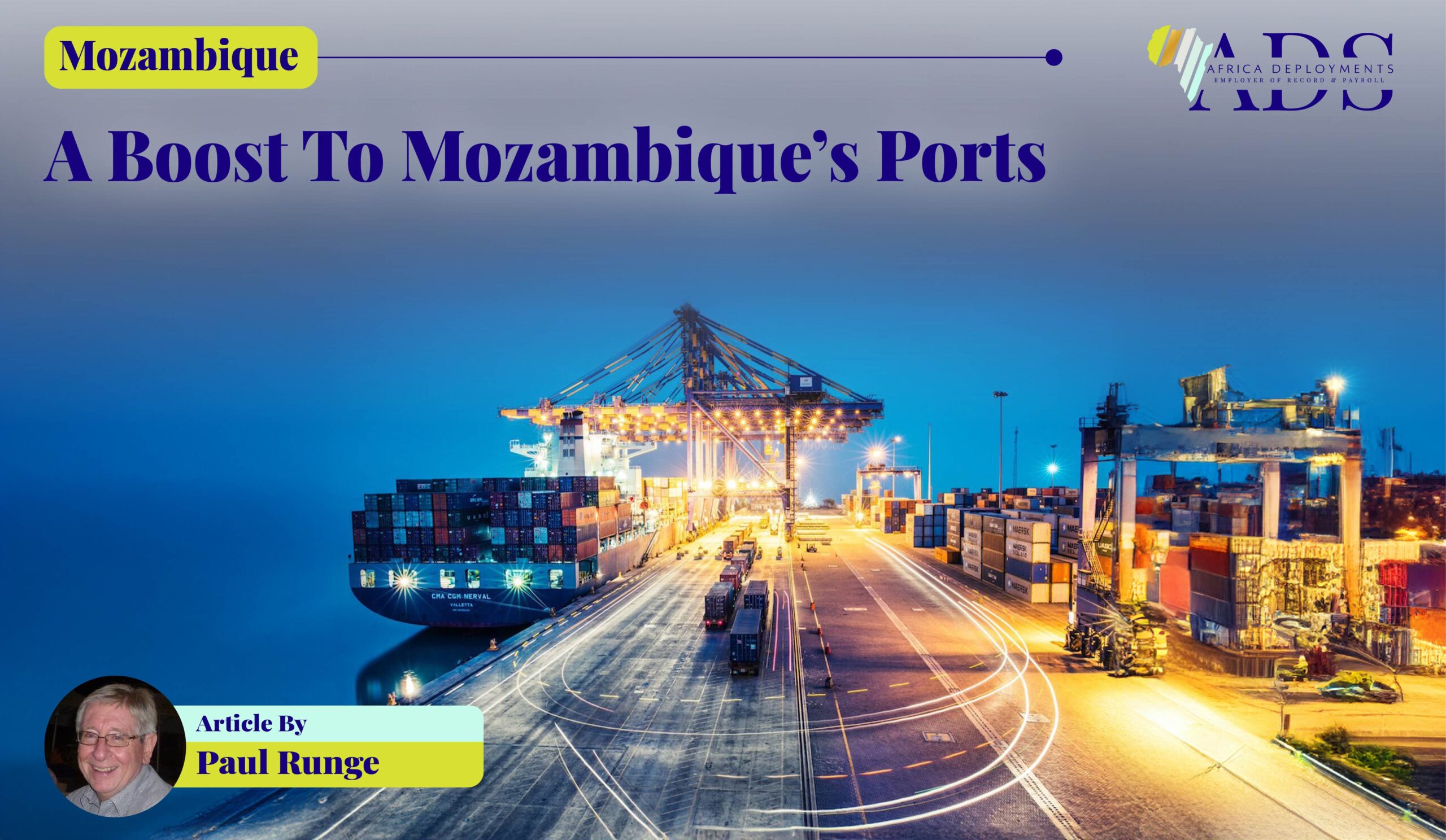

A Boost to Mozambique’s Ports

New Investments and Favourable Regional Developments

Mozambique’s ports…

Mozambique has a long coastline along the Indian Ocean of some 2 700 kilometres. It is mainly dotted with numerous bays and inlets which serve as small fishing ports such as Mocimboa da Praia in the far north in Cabo Delgado Province. Some are large enough to serve as commercial harbours. An example is Pemba, also in the north. Of the major seaports, there are the two historical operations at Maputo and Beira in the south and centre. A more recent development is the establishment of the country’s first deepwater port of Nacala in northern Mozambique’s Nampula Province.

I have had the good fortune to visit most of Mozambique’s main ports. I’ve enjoyed guided tours of Beira, Nacala and Pemba. I’ve even had a look at early-stage rudimentary harbour installations in the Afungi Peninsula near the border with Tanzania, where large-scale natural gas projects are being initiated. But, for some strange reason, I have never had the chance to visit the country’s largest port at Maputo.

Recent developments in Mozambique and in the southern African region are leading to strong interest by investors and developers in its ports.

A major investment in Maputo Port…

The road distance between Maputo Port and South Africa’s industrial heartland in Gauteng Province is only some 550 kilometres on the N4 toll route. This corridor has become increasingly vital for South African exports and imports. It is also a priority transport gateway for Botswana, eSwatini and Zimbabwe.

The Dubai-based logistics and port development group, DP World has announced that it will be undertaking a US$ 2 billion expansion programme at Maputo Port. The plan includes expansion of the port area from 140 to 270 hectares. Some 15 hectares will be claimed from the sea. The plan is to achieve a handling capacity of one million TEU’s (containers), per annum. The port requires considerable dredging.

The Mozambican government through its ports and rail utility, Portos e Caminhos de Ferro de Mocambique (CFM), has granted DP World a concession to manage, develop and operate the port until 2058.

And expansion planned for Beira Port…

Beira Port’s strategic geographic location in the central area of the Mozambican coastline means that it is the long-standing, chosen outlet for cargoes from Zimbabwe, Zambia, Malawi and the DR Congo.

The Dutch company, the Cornelder Group, is in partnership with CFM for the expansion of Beira Port. The US$ 290 million, 15-year expansion programme was initiated in 2023. It includes an increase in container handling capacity from 300 000 to 700 000 TEUs per annum. As in the case of Maputo Port, considerable dredging is required.

And expansion and modernisation of Nacala Port…

Nacala is Mozambique’s new natural deepwater port. It has a depth reaching 60 metres and can therefore handle large cargo vessels. It is an integral component of the Northern Development Corridor (CDN) connecting inland central Mozambique and Malawi to the port, which is linked by a 930-kilometre rail line through Malawi to the inland Tete coal mining area.

The expansion and modernisation of Nacala Port began in 2018. The objective is to achieve an annual general handling capacity of 10 million tons, and an increase of container throughput to 252 000 TEUs per annum.

And expansion and new installations for Pemba Port…

Pemba lies approximately 250 kilometres from the large-scale natural gas projects which are being prepared in the Palma area in the far north. Although small, it is the closest viable larger-scale harbour to the gas operations and could serve as a major support base for maritime cargo supply to the projects.

The development of a commercial port at Pemba includes an increase in the size and depth of the jetty at an estimated cost of nearly US$ 250 million. The major project is the construction of a floating quay for oil and gas vessels. A new 15-kilometre access road is underway. CMF hopes to achieve a container handling capacity of 12 TEUs per hour.

And special attention to Mocimboa da Praia Port…

The long-neglected port of Mocimboa da Praia lies only some 70 kilometres south of the natural gas operations in the Afungi Peninsula area near Palma. The port town has been disturbed by attacks from armed insurgents (who at one stage, even took control of the town). However, as relative peace returns, the government has recognised its potential for logistical support to the gas projects. (Palma is close to these projects, but does not have a natural harbour. The development of port facilities will be difficult and costly there.)

In 2022, CFM announced a project for the rehabilitation of Mocimboa da Praia Port.

Private participation as a key to developing Mozambique’s ports…

In 2011, the Mozambican government passed a law on Public-Private-Partnerships (PPP’s) for large-scale projects and company concessions. It has largely embraced the PPP concept and has been welcoming and facilitating private participation in the development of its ports well before the enactment of the PPP law.

The South African logistics company, Grindrod, is a shareholder with DP World and CFM in the Maputo Port Development Company (MPDC). In 2003, Maputo Port granted a concession to Grindrod and its partners for the operation of the designated port area. In 2007, the company announced an investment of US$ 80 million to expand coal and car handling at the port. It recently reported the handling of record volumes. The Trans African Concessions (TRAC) and the Maputo Corridor Logistics Initiative (MCLI) are groupings of private operators that (for some years now), successfully maintained the N4 toll route from the Gauteng Province-based industries of South Africa to Maputo Port.

Cornelder has been operating the container and general cargo terminals at Beira Port since 1998. It is collaborating with CFM to substantially improve the port’s handling capacity. Japan recently allocated US$ 249 million for the rehabilitation and modernisation of Nacala Port. The Japanese construction company, Penta-Ocean is undertaking much of this work.

The development of the ports at Pemba and Mocimboa da Praia will depend largely on interaction with the investors in the large-scale gas projects in Cabo Delgado Province.

Recent regional developments that are stimulating the growth of Mozambican ports…

In 1980, the Southern African Development Coordination Conference (SADCC) was formed as an alliance of southern African states. Among other objectives, it aimed to reduce trade dependence on the (at the time, minority-ruled) South Africa. It later became the Southern African Development Community (SADC), with the new democratic South Africa as a leading member.

Today, the SADC member countries are once again lessening their economic dependence on South Africa. In particular, they are decreasing their reliance on South African ports. Mozambique, Zambia and Malawi recently concluded an agreement for the effective management of the Nacala rail corridor linking land-locked Zambia and Malawi to the Mozambican port.

There are numerous reports of major improvements of southern African ports: Maputo, Beira, Walvis Bay, Lobito and Dar es Salaam. This surge in regional port improvements has come largely as a result of the well-publicised deterioration of South Africa’s ports and rail infrastructure.

Need for greater private participation in South African port management…

Unlike Mozambique, South Africa’s transport utility, Transnet, has been less keen on private participation in the management of its ports. South African export companies have offered assistance. For example, the Cape Chamber of Commerce and Industry is currently coordinating initiatives to reduce bottlenecks at Cape Town harbour.

However, the South African government appears to have taken cognisance of the logistics crisis, and is changing its stance. The South African private sector has welcomed the state’s establishment of the joint public-private National Logistics Crisis Committee that aims to draw in private expertise to resolve the transport problems – problems which bedevil South Africa, and encourage the rest of the region to take alternative measures.