Zimbabwe’s Lithium Bonanza The Challenge of Assuring Maximum Local Benefit

Long-standing belief in the country’s mining potential

It was 1965, the year of Rhodesia’s Unilateral Declaration of Independence (UDI). Despite global condemnation of this political rebellion, there was strong optimism among many of the country’s White minority population regarding the country’s future. I was a teenager out from South Africa on a family visit to my uncle in Bulawayo, second city of the then-Rhodesia and later-Zimbabwe.

“This country of ours is so rich in mining. We have platinum, nickel, gold, precious stones and much more. The world can’t ignore us.” The words of my proud uncle. He didn’t mention lithium.

Lithium: The much sought-after battery mineral

Lithium is well-recognised as a critical mineral for emission-reduction technologies and the world’s transition to cleaner energy. It has been dubbed ‘white gold’. Lithium-ion batteries are used for storage of renewable energy, the manufacture of electric cars, laptop computers, smart phones, electronic goods and even glass. A key advantage of lithium-ion batteries is their high-energy density, allowing them to store a substantial amount of energy in relatively small and light-weight packages.

The world needs lithium, and demand for it will undoubtedly experience strong growth. Expected output for 2023 was almost one million tons. The World Economic Forum predicts that lithium production will reach over three million metric tons by 2030.

The global price of lithium is volatile. Much depends on the sales of electric vehicles in China and the general slow-down in the Chinese economy. Growth of the world electric vehicle market has been sluggish of late, with a corresponding decline in lithium prices. Nevertheless, the mineral remains high-value. Goldman Sachs has forecast the price for lithium carbonate in 2024 at US$ 13 377 per ton.

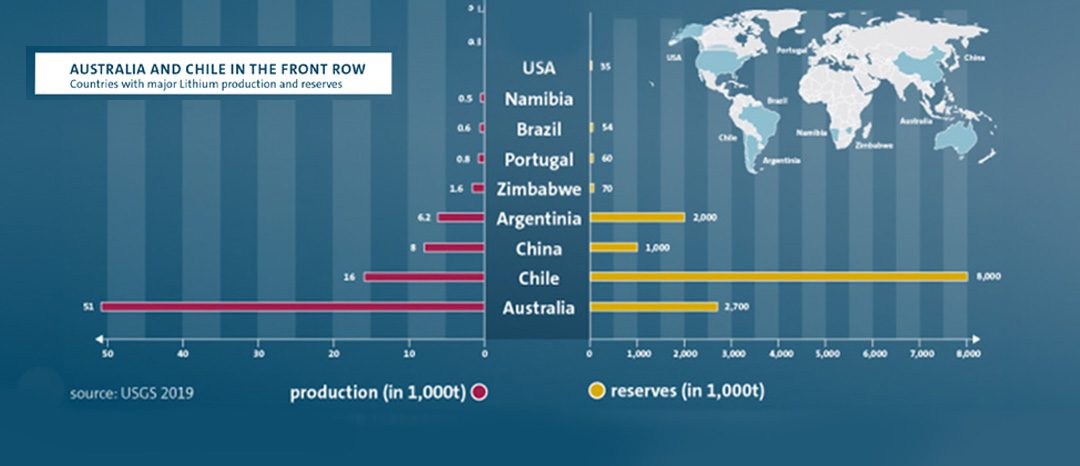

Zimbabwe’s world ranking as a lithium producer

The world’s major lithium producer (by a large margin) is Australia, which produced 61 000 tons of lithium in 2022. Chile ranks second with 39 000 tons in the same year. Other producers are China, Argentina and Brazil.

In Africa, lithium deposits are found in Zimbabwe, Namibia, the DR Congo, Mali and Nigeria. Zimbabwe is by far the continent’s most blessed with analysts estimating that the country could potentially produce 20% of world demand. The country produced 900 metric tons in 2022, and 3 400 tons in 2023. This figure is likely to rise substantially in the coming years.

Zimbabwe’s history of lithium mining

Lithium was reportedly discovered in the mid-1900’s by the Irish geologist, George Nolan. Mining began in 1953 at Zimbabwe’s largest lithium mine, Bikita, situated in Masvingo Province, southern Zimbabwe. The past decade saw a flurry of activity. Commercial mining began at Zimbabwe’s second largest lithium prospect, Arcadia, east of Harare, in 2016. Other lithium mining projects that have emerged include the Step Aside mine, close to the Arcadia project; the Zulu lithium and tantalum venture in the Bulawayo region; the Sandawana mine in the Midlands Province and the Sabi Star mine in Manicaland Province, south-eastern Zimbabwe.

Strong Chinese presence in Zimbabwe’s mining industry

From mid-2023, the Zimbabwean authorities awarded mining licenses to a number of Chinese investors. This development was accompanied by reports of large-scale Chinese investments in Zimbabwe, with a special focus on lithium projects. Chinese companies are using their access to capital to gain access to the operations of Canadian, Australian and other junior miners.

In June 2022, the Sinomine Resource Group bought the Bikita lithium mine for US$ 180 million. The Chinese group also announced an investment of US$ 300 million in Bikita to build a processing plant and to expand its operations there. In the same year, Prospect Resources of Australia sold its controlling interest in the Arcadia lithium mine to Zhejian-Huayou Cobalt. The Shanenzhen Chengxin Lithium Group owns the Sabi Star lithium project through its Zimbabwean subsidiary.

While some lithium projects remain in other hands, China is clearly leading the lithium investment race in Zimbabwe. The giant is supporting its Zimbabwean initiatives with investments in processing plants and support infrastructure.

There have been accusations that Chinese and other operators are managing to export unprocessed lithium. However, there have been Chinese local beneficiation initiatives. Zhejiang Huayou Cobalt inaugurated its US$ 300 million lithium processing plant in 2023, and the Shenzhen Chengxin Lithium Group financed the construction of a concentrator at its Sabi Star lithium mine.

The Zimbabwean government tries to ensure maximum local beneficiation

The Base Minerals Export Control Act of 2023 aims to halt the export of non-beneficiated minerals, including lithium. Zimbabwe’s government was enforcing the beneficiation of mining production before the Act was passed. The export of unprocessed lithium was banned as far back as December 2022. These measures have shown positive results. The Treasury recently reported that the country’s earnings from beneficiated minerals increased by 283% over two years since 2020. The goal is to achieve a US$ 12 billion mining economy.

But a mining industry faced with socio-environmental challenges

A major objective of banning the export of non-beneficiated lithium was to prevent the trade of artisanal miners. Zimbabwe has a long history of artisanal mining. On some occasions, the military has been called in to remove these miners from mining sites. A well-publicised example is that of the army’s expulsion of artisanal diggers at the Marange diamond fields. Despite efforts by the government to clamp down on artisanal and illegal mining, it is estimated that some 500 000 artisanal and small-scale miners are active in the country.

Local communities are participating in lithium mining and selling their production to both legitimate and illicit buyers. The problems of smuggling and the illegal export of unprocessed lithium remain despite governmental measures. The act banning export of unprocessed lithium refers to exemptions under “exceptional circumstances”, and unscrupulous producers could be taking advantage of this loophole.

Various non-governmental organisations have expressed their concern over poor wages the operators pay their workers, as well as poor safety standards and insufficient investment in social facilities for mining communities. The deaths of two miners at the Arcadia mine and a reported mine collapse at the Sandawana mine drew attention to the issue of mine safety.

Environmental degradation is another major problem. A recent report by the Zimbabwe Environmental Law Association draws attention to this problem, as well as to the exclusion of views from affected communities.

This is the challenge that the Zimbabwean authorities face: how to fast-track and maximise benefit from its ‘white gold’ resource, while also minimising ill effects to the environment, and ensuring safety and benefit for the populace.